Important Tax Information

On June 21, 2018, the Supreme Court of the United States ruled in favor of the state in South Dakota v. Wayfair, Inc. The decision allows states to tax remote sales.

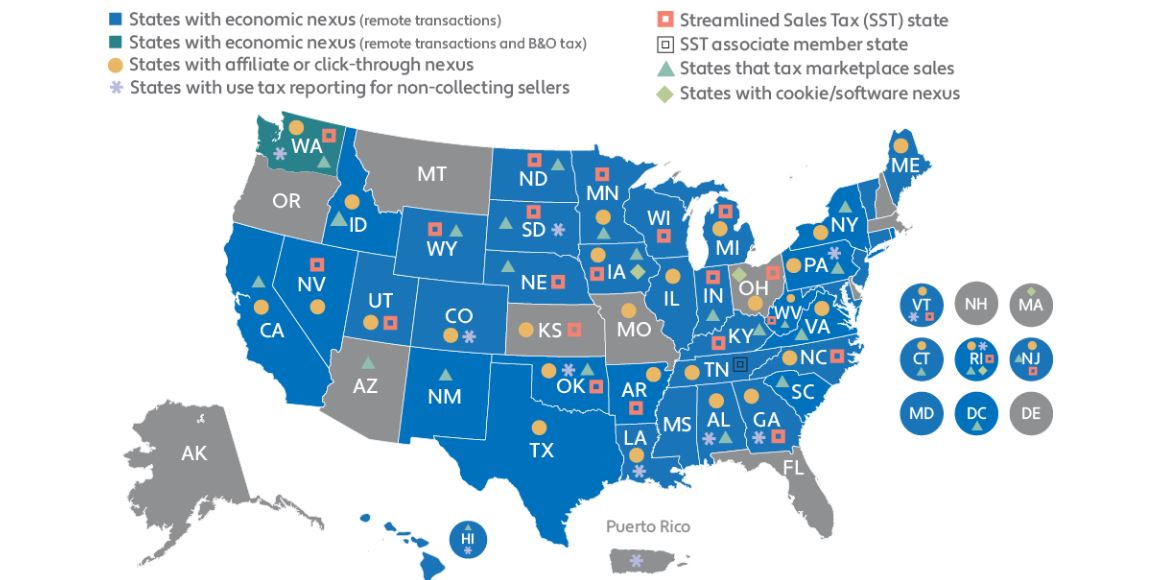

It used to be that states could only tax sales by businesses with a physical presence in the state. Now economic activity in a state - economic nexus - can trigger a sales tax collection obligation. Economic nexus is based entirely on sales revenue, transaction volume, or a combination of both. See the chart below for more details.

Because of the volume of sales that we have, we meet the economic nexus in all states that require remote tax collection